All Things Public, Vol. 2: Population Growth and Progressivity!

Happy New Year!

Starting off 2024 strong with a jam-packed second edition of All Things Public, the pro-public, anti-austerity, "we live in a society" newsletter. With the holidays just passed, I was anticipating a quiet few weeks on the tax front, and then suddenly I had three substantial reports to cover. Population data, progressivity rankings, AND tax rate numbers. Business is good!

As always, please don't hesitate to reach out with questions, comments, or thoughts of your own. Here are mine:

Population Growing; Tax Flight Losing Altitude

Shortly after the last email, the U.S. Census released its newest estimates for population growth in all 50 states. As I covered in a piece for the Reformer, it was generally good news for Minnesota, with population numbers rebounding substantially from the year prior. Importantly, most of the ground made up comes from a decrease in net out-migration, which flies in the face of the conservative "tax flight" narrative. Although we are still losing more residents to other states than we are gaining, the two-year spike in out-migration has seemingly subsided and things are now trending in a better direction.

Here are my top counter-arguments to the tax flight narrative:

There is little evidence that taxes are what's driving migration. While some people undoubtedly consider taxes when picking a new location, surveys and basic logic both suggest it's a small part of the equation. When asked, people tend to cite weather, job opportunities, or the cost of living as their reason for moving. Furthermore, the most substantial migrating demographic is college-aged students who are not likely choosing a school based on state tax rates.

Tax flight arguments rest on poor comparisons. Tax flight arguments tend to compare Minnesota to Texas or Florida, and draw the unfounded conclusion that taxes are driving these patterns. In truth, this trend is largely regional: Americans are moving West and South. If taxes were the issue, states like Kansas and Ohio would be exploding, but that's not the case. Among nearby states, MN sits in the middle of the pack, with better or similar migration numbers as many lower-tax states in the region.

High earners aren't fleeing. Another reason to question the tax flight narrative is that high-earners are not actually leaving. As I discuss in my recent Reformer piece, Mark Haveman at the Center for Fiscal Excellence has a great blog post showing that Minnesota's negative net migration is not the result of lots of people leaving, but relatively fewer people coming in. Among high earners, Minnesota does have one of the lower rates of inbound migration, but it also has one of the lowest rates of outbound migration. As one expert quoted in the essay put it, "it's really hard to get people to move to the Twin Cities but it's about impossible to get them to leave." That's a very different picture than we get from tax flight proponents.

Anyway, we're already doing everything we can! With a veritable tax haven as a neighbor on at least one border, Minnesota will never compete for low taxes in the Midwest. And we shouldn’t. From jobs and wages to education and life expectancy, Minnesota vastly outperforms most other states in the country, let alone the region. Investing in an equitable society and a high quality of life is the only sane way to attract more residents, and that's what we do best.

I didn't feel great about the readership on this latest Reformer piece because it was published just a few days before Christmas, but thankfully I can rest assured knowing this debate will continue forever .

Most Progressive State Tax Code in the Country!

On Tuesday, the Institute on Taxation and Economic Policy released its annual "Who Pays?" report, comparing the tax codes of all 50 states and D.C. After recent tax hikes on the wealthy and new credits for low-income families, Minnesota now has the most progressive tax code of any state in the country. That's (mostly) great news resulting from decades of hard work and advocacy by legislators and many We Make MN allies. Having said that, I have some reservations:

Progressivity is one popular measure of “vertical equity” — a principle of sound taxation, which holds that tax burdens should generally rise with wealth and income. Technically speaking, a progressive tax is one that costs higher-earning families a larger percentage of their income than lower-income families, and a regressive tax is one where the opposite is true.

I agree that vertical equity is important, but I am concerned about a single-minded focus on "who pays?" over "what do we pay for?" America is the lowest-tax wealthy nation on earth, and it's not particularly close. From healthcare to childcare to a stronger safety net, Americans go without basic social protections that are commonplace everywhere else. In other countries, these programs are funded by broad taxes that are regressive on the revenue side, but enormously progressive in their distribution. Advocates of a more progressive tax structure mean well — and with runaway inequality we do certainly need to tax the rich — but the single-minded focus on vertical equity risks ignoring the broader push for more and better public services.

Broad taxes, like those on property or sales, contribute an enormous amount of revenue to our state and local budgets, and rich taxpayers do pay more of them than poor and middle class taxpayers because they purchase more taxable goods and own more expensive homes. But these taxes are considered regressive because, while a rich Minnesotan might pay 5-times as much in sales taxes, they can ear 10 or 15-times more income. By adhering to a strict progressivity standard, I worry that we risk unintentionally adopting an inherently anti-tax position. After all, 13 of Minnesota's 15 state taxes are technically regressive.

These are all arguments I have made before, so I'll stop there for now. But it's definitely not that last time I'll be talking about this!

A New Report on MN's Fiscal Position

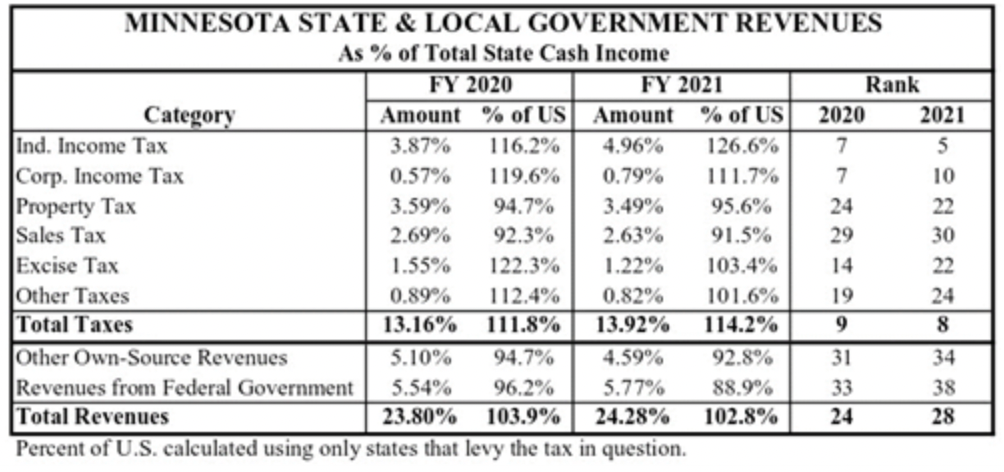

As many of you know, I am a big fan of Mark Haveman at the Center for Fiscal Excellence. Every year, CFE puts out a comprehensive analysis of Minnesota's taxes and spending as compared to other U.S. States. The latest edition, covering FY 2021 (June 2020 to July 2021) gets us our first good look at the impact of the COVID pandemic on the state's fiscal rankings. Much is unchanged: Minnesota is a relatively high-tax state, but that is substantially balanced by lower non-tax revenues, including fees for service and federal funds. This means our overall ranking for spending is considerably lower than many might imagine. The table below breaks down the headline revenue numbers and there is an equally interesting table on major expenditure areas.

Haveman, whose organization is funded by business groups, has his concerns about the impact of Minnesota's taxes on business investment and the economy. I don't share all of his conclusions, but his analysis is first-rate and his organization is an important voice in the Minnesota fiscal discourse. The report is an excellent resource for measuring Minnesota's revenues and spending across different areas and tax types and I highly recommend that those interested give it a look.